During today's Midwinter Capital Weekly article, I will be exploring the possibility that

Bitcoin has peaked or is close to peaking out for the month and indeed the

quarter.

Additionally, I will be looking at the other side of the trade, and where BTC heads

next due to the potential supply shock, and if this is just the start of a

much larger price towards $50,000 and beyond.

Starting with the evidence that Bitcoin may have peaked let's start with trading

psychology. BTC bears looking to initiate shorts would ideally like to place a short

with the stop around or slightly above the current 2024 high and a target sub

$40,000.

Source: TradingView.com

Certainly, the recent push to $48,000 plus would present an excellent risk Vs reward

opportunity for bears who were searching for a lower high on the weekly chart.

From a purely technical perspective, Bitcoin has also made a beautiful technical retest

of the most important trendline on the higher time frame charts in my opinion.

Source: TradingView.com

This trendline denotes the neckline of a massive head and shoulders pattern on the

higher time frames that have been in play since 2022.

Other evidence of an important top being in place or close to in place includes

Bitcoin reaching the 100% Fibonacci target of the $38,500 to $43,900 range break this

week.

Source: TradingView.com

The technicals also show that a large inverted head and shoulders pattern was invoked

during the breach of the $43,900 level this week.

Also, this particular pattern holds a bullish target of around $5,500, which takes BTC

close to $49,500, which is ofcourse a new 2024 high and means BTC is going higher again

this week.

Source: TradingView.com

Also of particular note the "Bitcoin has already peaked" argument

includes massive amounts of negative MACD price divergence forming this week.

Source: TradingView.com

Plus, we can see the highly leveraged traders on Binance futures are stacked Long in a

big way since Thursday.

Finally, at the start of last week a large Market Maker signal (purple candle) formed on

the PVSRA Volume indicator, pointing to this rally being pure market manipulation.

Source: TradingView.com

Now for the bull case continuing next week and into the next few weeks. Starting

with the fundamentals the increased uptake of the Bitcoin spot ETFs this week has

no doubt contributed to supply shock FOMO and a newfound sense that Bitcoin could have

already staged its pre-halving pullback and is beginning to start its ascent toward a

new cycle high.

Source: TradingView.com

This theory is further complimented by the SuperTrend indicator flashing its fourth-ever

monthly buy signal, and one that has been closely associated with the bull market cycles

of old.

Furthermore, the PVSR Imbalancer indicator highlights a significant breakout

through of untaken liquidity that was breached this week after the price sliced through

the $45,500 area.

Source: TradingView.com

The next batch of untaken liquidity sits around $55,000, meaning Bitcoin is a very risky

short trade while the price sits around current levels.

Fibonacci analysis also shows that the $57,000 area is a major target if bears gain

serious traction above $48,000 next week.

Source: TradingView.com

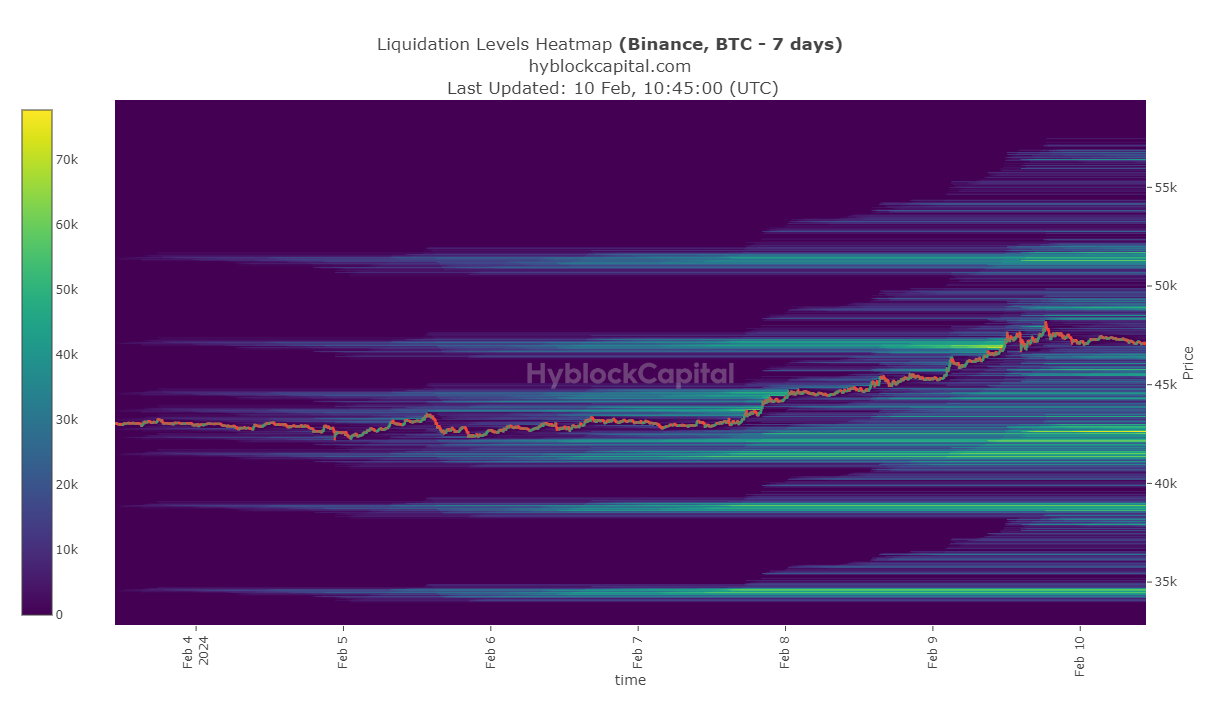

Liquidation level data shows that the most amount of liquidations on the upside sits

around the $50,200 to $51,600 area this week, while the largest amount of downside

liquidations sits around the $43,000 to $41,000 levels.

Source: HyBlockCapital.com

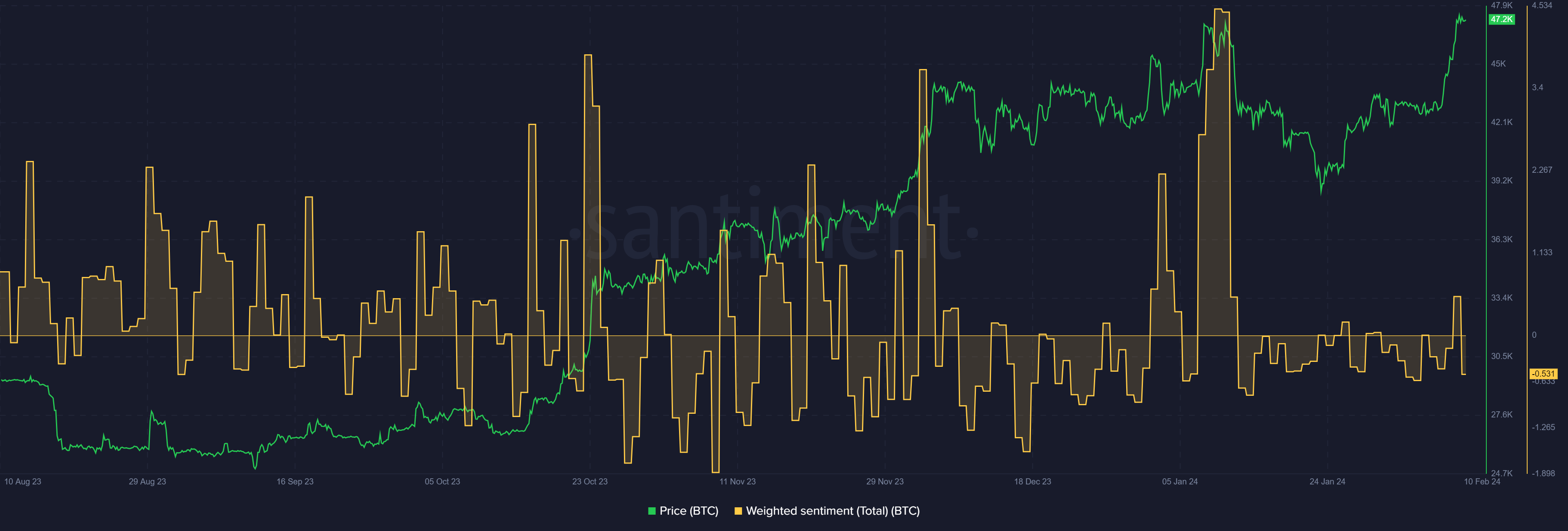

During the coming week ahead I would suggest keeping a close watch on the key rising

trendline, plus social sentiment. As things stand we are not seeing the euphoric

sentiment that we did during the spot pre-ETF phase.

Without a major spike in crowd FOMO it could well mean that Bitcoin has the

potentiality from a contrarian perspective to head much higher.

Source: Santiment.net

Bears seeking confirmation of a sell signal will need to see alot of evidence to go

short given the power of this week's move.

Technical closes under $46,500 or $45,500 might not cut the mustard at this stage. Moves

to that area could still be seen as a buying opportunity.

Only a sustained dive under $43,000 would in my opinion convince the market this

rally is a fake.