After covering technical analysis and on-chain in recent weekly articles I thought this

week I would take a look at Midwinter Capital's quantitative indicators to analyze

Bitcoin.

Recently, Midwinter Capital published its quant framework for paying subscribers, similar to a

white paper, however, it is still very necessary for other members to understand

our quant models and also be informed what they are saying and currently alluding

to.

On this subject, we plan to host another informational webinar in the first week of

April and go over the strengths and weaknesses of each approach for short-term and

long-term investors.

Source: Midwintercapital.com

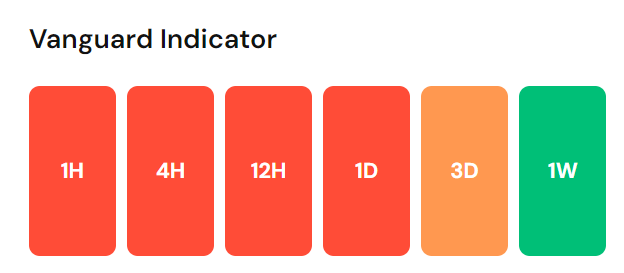

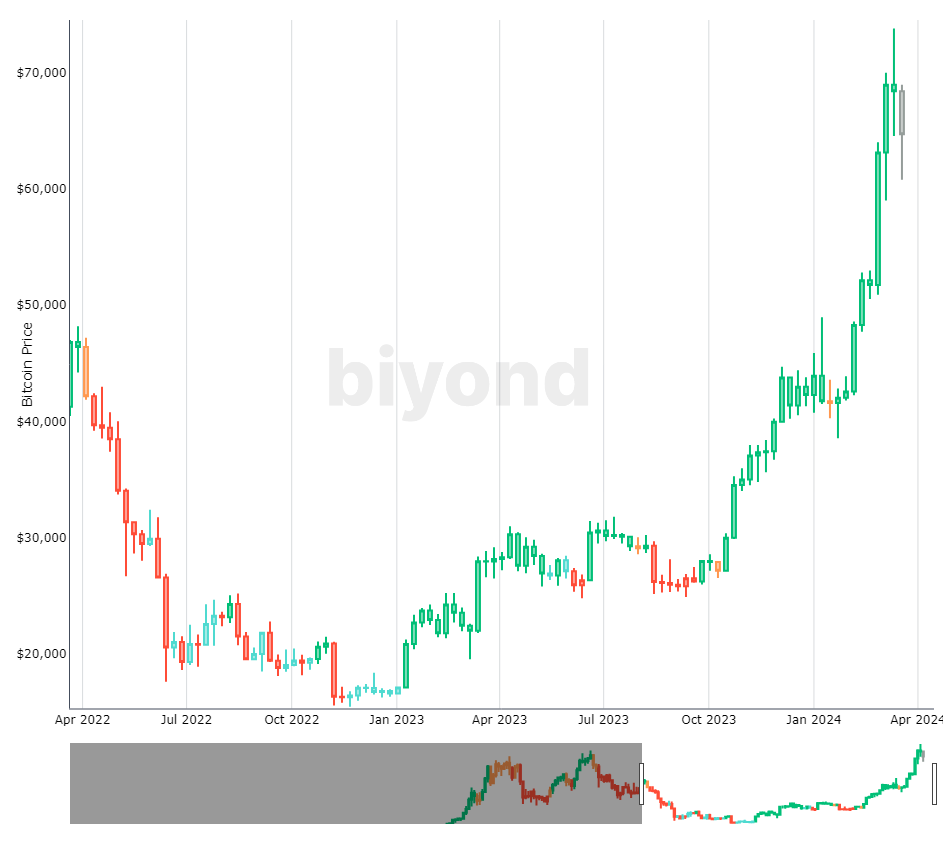

Starting with Midwinter Capital’s main protective and trend following quantitative model is

Vanguard, probably my favorite Midwinter Capital quant model.

It's quite simple to use, with Red for strong bearish trends, Orange for bearish

inclination, Blue for bullish inclination and Green for strong bullish trends across

multiple time frames.

Source: Midwintercapital.com

Being a medium-term trader I tend to use the daily, 3-day and weekly time frame

combination. With that said the 3-day and weekly time frames are really the ones to

watch right now.

Source: Midwintercapital.com

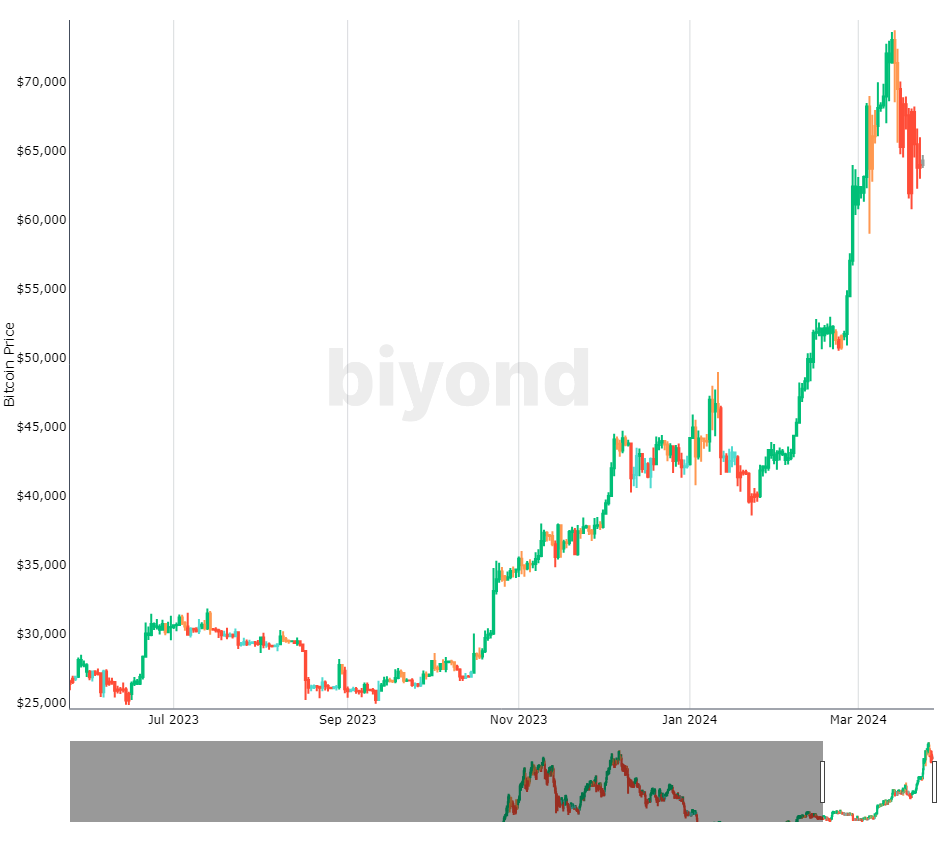

As you can see the weekly Vanguard has captured the up move perfectly, and any change in

colour could signal and temporary or significant trend correction, despite the

recent $13,000 plus pullback.

All eyes are on the weekly time frame next week, and also the three-day time frame which

has switched to amber to further alter the potentiality for a daily and 3-day bearish

combo.

Source: Midwintercapital.com

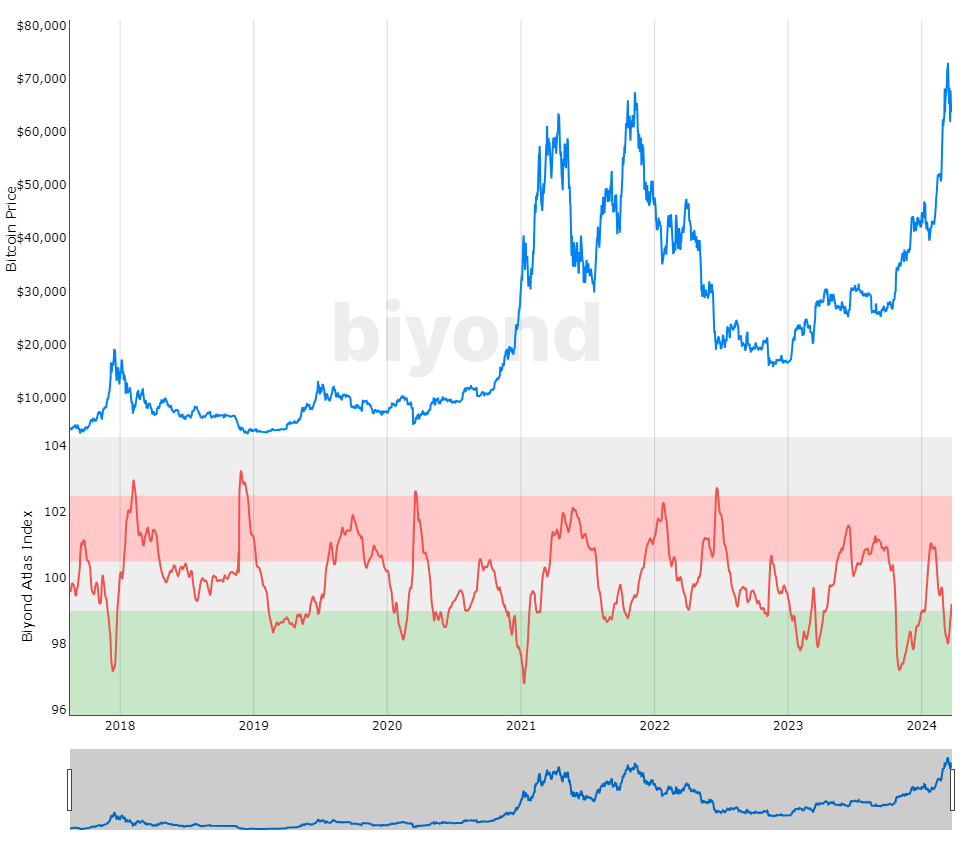

My next favorite indicator is Midwinter Capital Atlas, which basically harnesses the capabilities

of machine learning to analyze six critical and distinct categories off-market

factors.

Remember this indicator exhibits an inverse relationship with the price movement. For

the uninitiated up means down and down means up in layman's terms.

After recently being in overbought territory we are seeing a very obvious up correction

in this indicator as the price moves lower.

Source: Midwintercapital.com

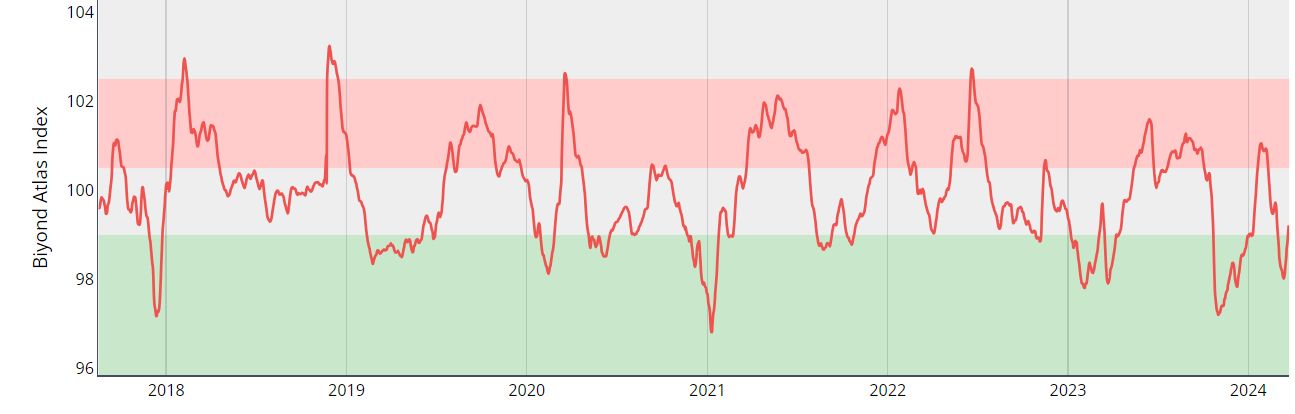

The key point to watch is the 100 marker or barrier. Downside momentum increases if the

100 marker or level is crossed on this indicator.

Downside momentum would further increase if the price moves into the red zone, and

oversold conditions would happen if the indicator moved from red into the grey zone.

All eyes on the 100 marker/barrier for Midwinter Capital Atlas over the coming days and indeed

whether Midwinter Capital Vangurd will flip to red on the weekly or continue its epic

continuation in the green journey, which has been unabated since October 2023.