Last week I wrote about the potential for a correction and specifically an interim

price top forming as Bitcoin looked overstretched by many metrics.

This week I would like to provide an on-chain update for Bitcoin and Ethereum as some

signs have emerged to complement the potential interim top/correction theory.

Source: Tradingview.com

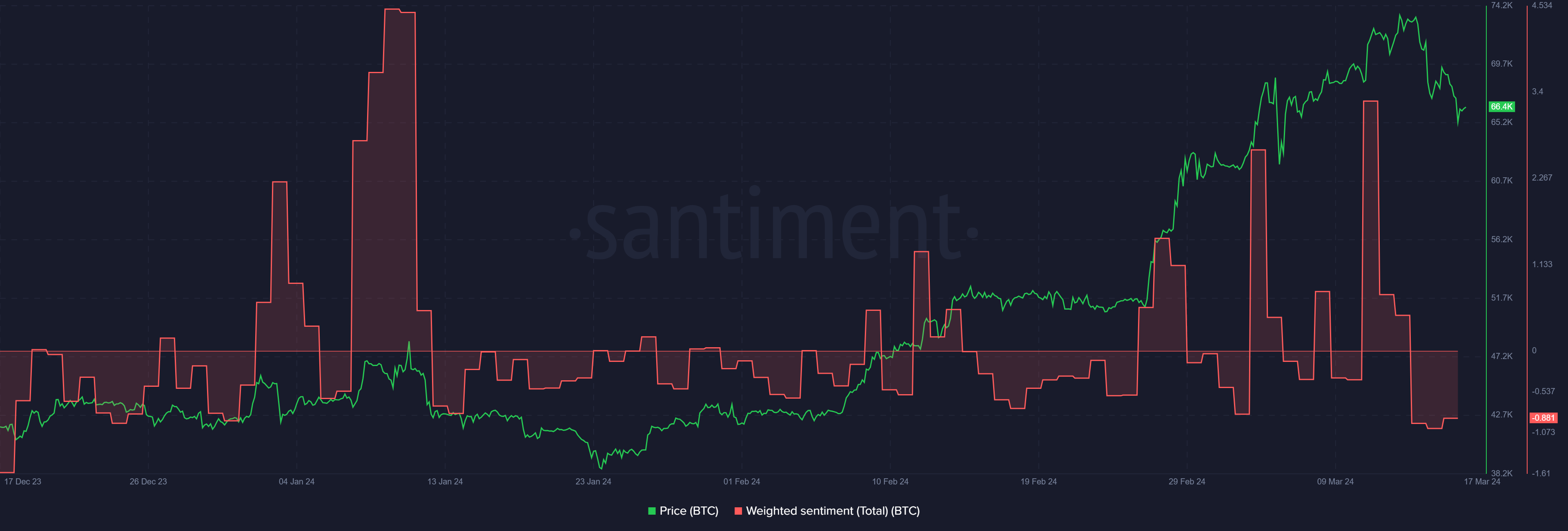

Before I get to the raw on-chain metrics I would like to touch upon sentiment as some

fairly significant social readings have taken place.

According to Weighted Social Sentiment data from Santiment Bitcoin registered its

second-highest spike in this metric for 2024 this week.

Source: Santiment.net

Weighted social sentiment combines the ratio of positive vs. negative mentions over time

vs. the frequency of overall mentions.

Large spikes in this metric have typically ushered in large price corrections as they

seem to capture "peak euphoria" amongst traders.

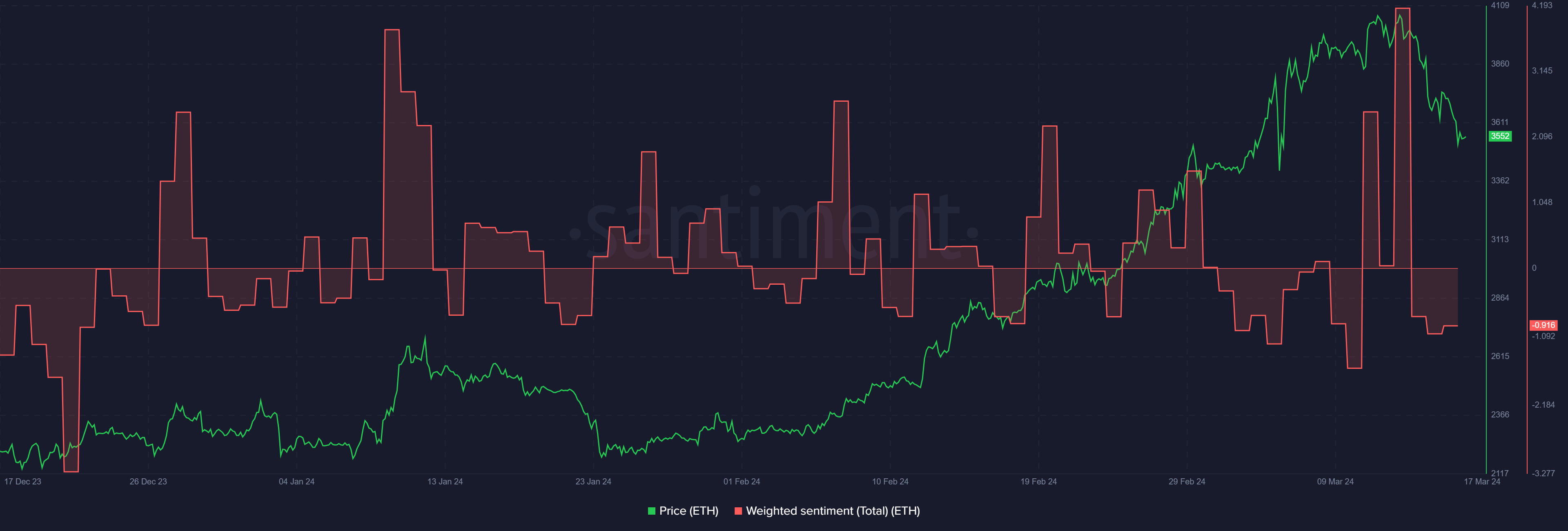

Also of note is the fact that Ethereum also registered one of its biggest ever spikes in

Weighted Social Sentiment this week.

Source: Santiment.net

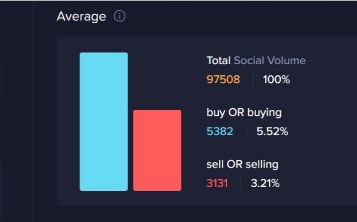

Also, "Buy Bitcoin" calls are double "Sell Bitcoins" on social

media, further enhancing the bear case as retail trader confidence in dip-buying is

currently sky-high.

Source: Santiment.net

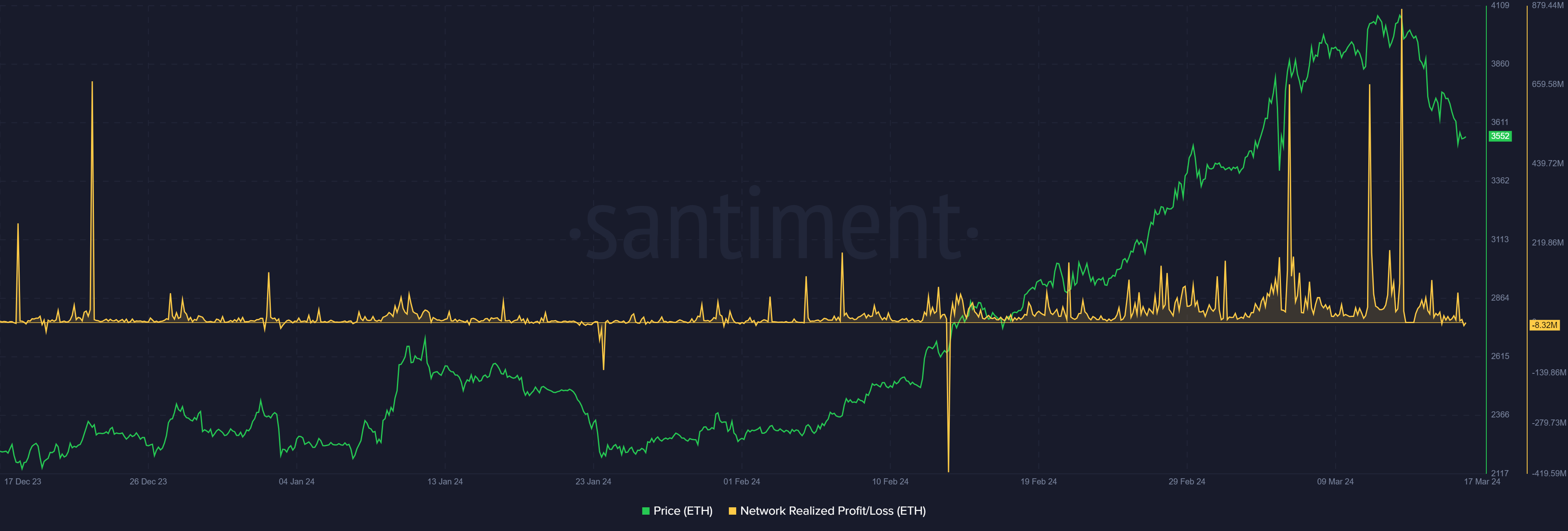

Back to on-chain metrics and Etheruem actually registered far more big spikes in

top/bottom metrics this week than Bitcoin.

Bitcoin recorded no major spike in Network profit/loss this week, however, Ethereum did

above the $4,000 level.

Source: Santiment.net

As soon as the spike happened a big drop in ETH/USD quickly ensued.

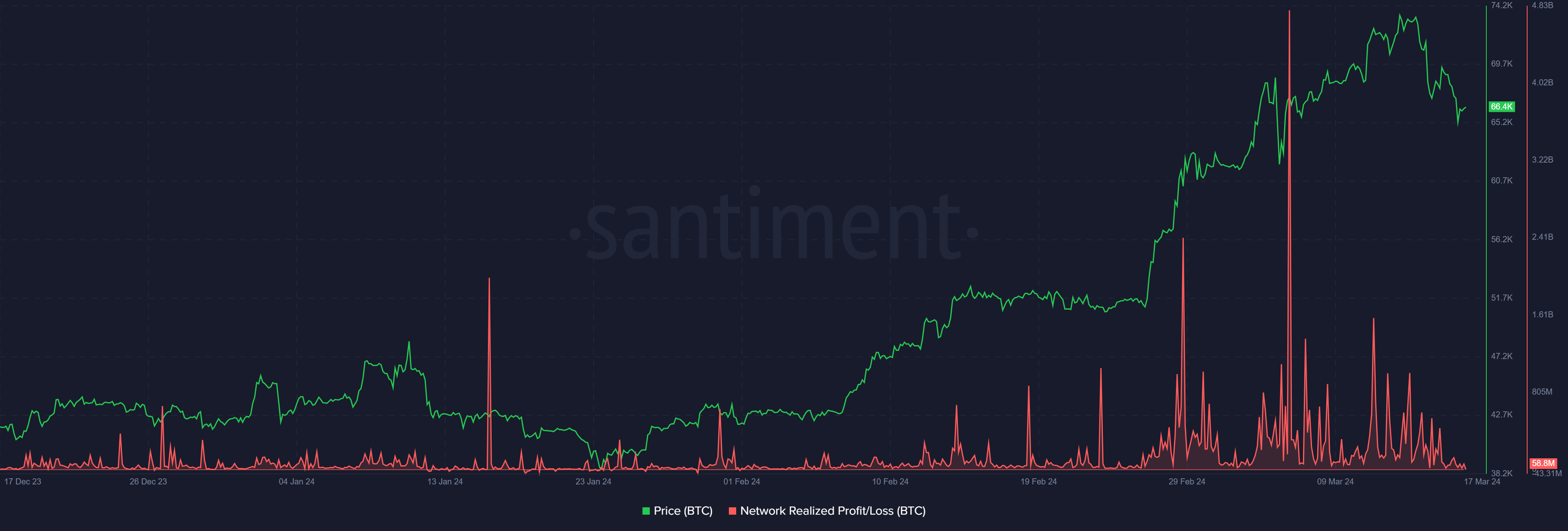

Interestingly, Bitcoin registered its largest ever spike in Network profit/Loss during

the previous weeks pullback around $66,000.

Source: Santiment.net

This could make very interesting times around the ahead if the $66,000 level holds or

folds. It certainly seems to be a very interesting level to watch for directional clues

during the coming week.

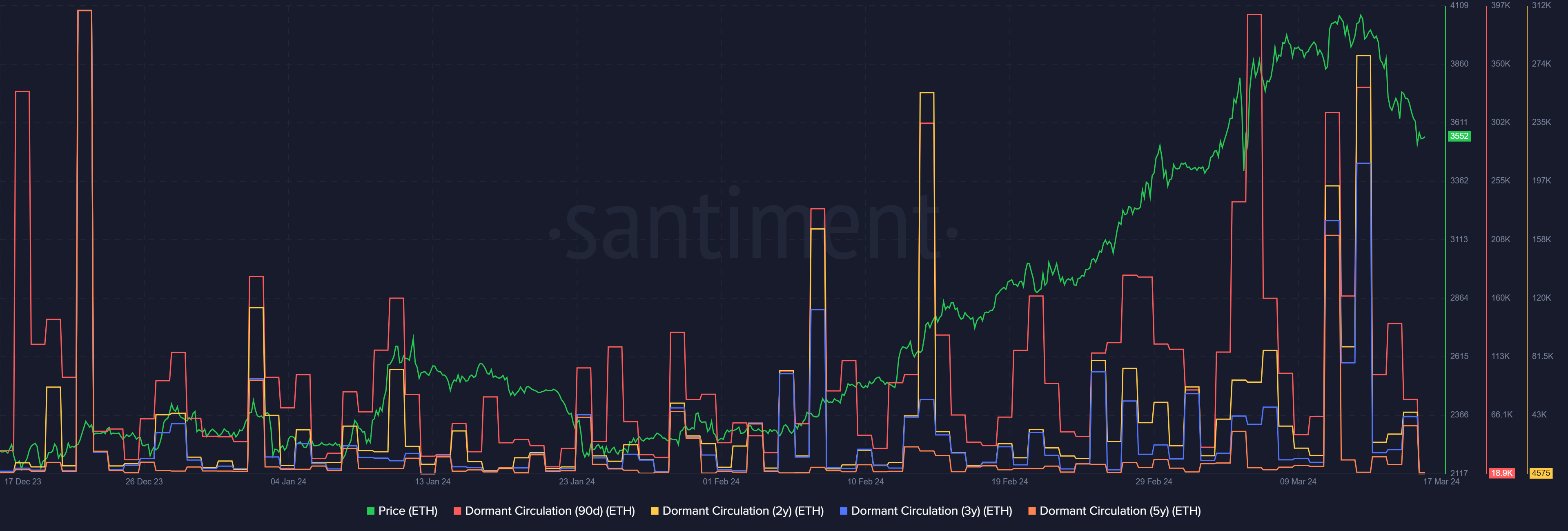

Massive Dormant Coin activity took place around the highs for ETH, further alluding to a

major ETH downside correction to come.

Source: Santiment.net

However, Bitcoin only registered large Dormant spikes around $66,000 but not around

$73,000.

Source: Santiment.net

What this means is up for interpretation, but in my opinion this further underlines the

earlier point I made about $66,000 being a pivotal area to watch and these spikes being

very signifcant.

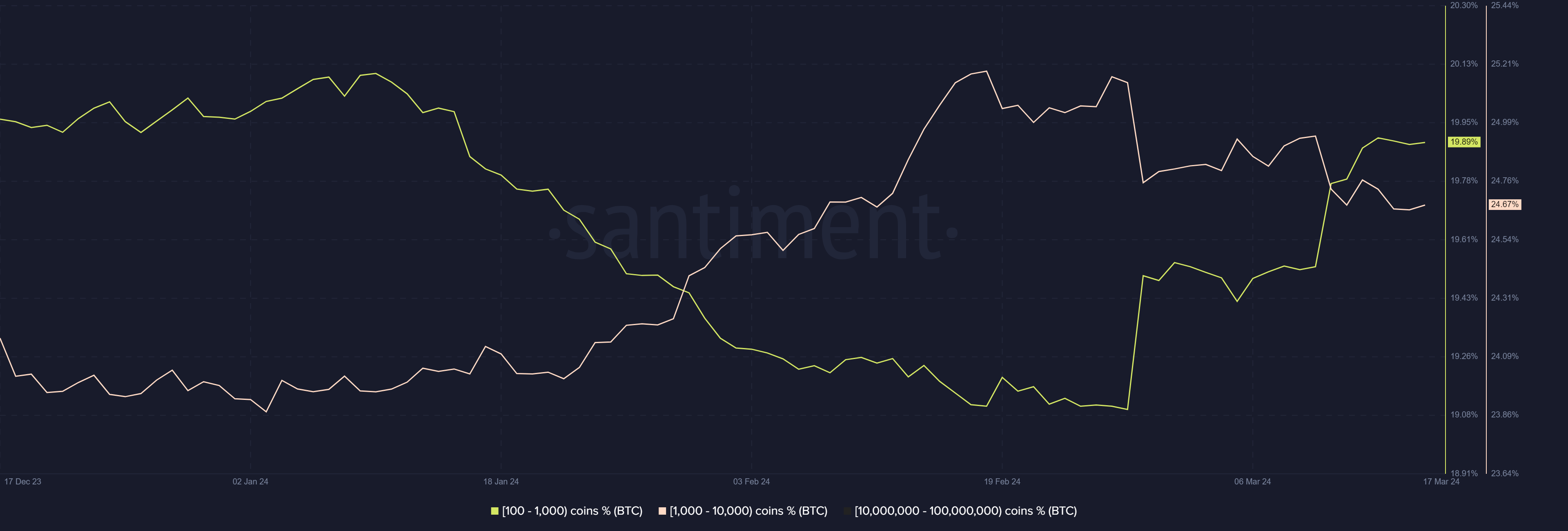

And finally, Whale data is inconclusive for Bitcoin right now as mid-tier whales and

shark addresses do exactly the opposite of each other.

Source: Santiment.net

ETH whale data is more interesting. One of the largest ever mega whale buy-ins or spikes

happened this week. However, other whale data is pretty muted.

Source: Santiment.net

Next week should be very interesting as no doubt some potential interim signals have

emerged on-chain as evidenced above for BTC and ETH.

The price action around $66,000 will likely to dictate play and also ETH could be a big

decliner if the outlined on-chain metrics are correct.