This week I thought I would take a deeper look at the situation surrounding the Genesis

bankruptcy, primarily because it could provide a solid recent for the cryptocurrency

market to stage a downside correction.

With Bitcoin receiving enormous inflows into the newly created spot ETF's it is

by no means sorted that this selling event could create significant downside

pressure on Bitcoin, however, I think the idea is worth exploring.

Starting with what we know. A judge this Wednesday granted a motion from

Genesis to allow the bankrupt lender to sell its shares of Grayscale’s bitcoin ETF

(GBTC).

Notably, this motion now allows the debtors to begin selling the shares at their

discretion and does not set up a timeline. The lack of a clear timeline is significant,

as it adds a layer of uncertainty to when a sell shock could arrive.

In case you weren't aware the bankrupt lender Genesis is expected and wants to

offload around $1.3 billion of Grayscale’s bitcoin ETF GBTC.GBTC will likely

experience more selling pressure after seeing a wave of it over the past month.

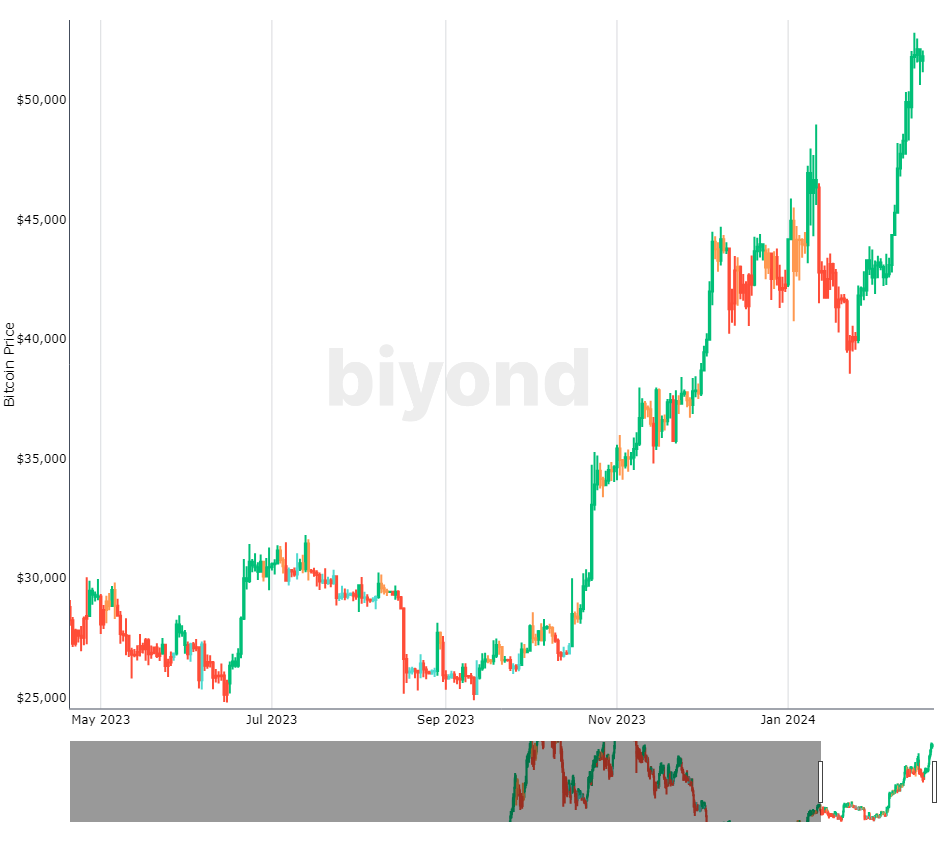

Source: TradingView.com

As well as substantial minor selling at the time, the first wave of GBTC selling

arguably caused or greatly contributed to the massive price drop to $38,500 in

January.

Still, it very much remains to be seen how the selling of GBTC shares by Genesis will

affect the price of Bitcoin in the long term.

Experts, including Bloomberg Analysts James Seyffart and Eric Balchunas, believe that

the impact this time may not be as severe. I for one suspect this event is not

already priced in, even though the market expects it.

Seyffart suggests the exact amount that has already been sold remains uncertain. I would

suggest weekend selling would affect Bitcoin than weekday selling due to the ETF's

being a key buyer on dips.

Rumors persist that selling of around 4,000 Bitcoin has already taken place to a

Coinbase premium over recent days, thus the success and liquidity demonstrated by the

new Bitcoin ETFs indicate points to instant market absorption.

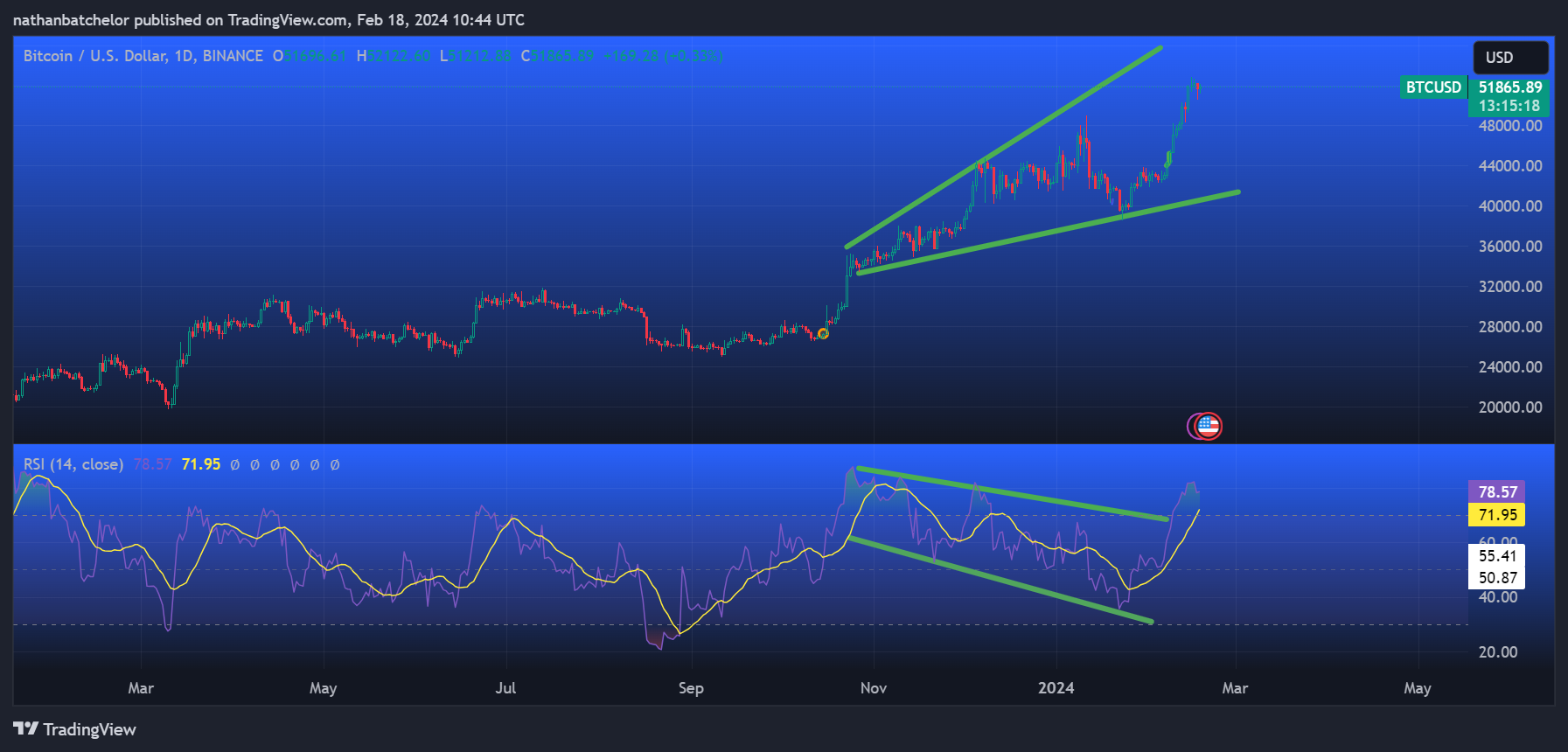

Looking at the market through the lens of technical and on-chain analysis there is scope

for a correction towards the $46,000 price area.

Source: TradingView.com

The bears would need to crack and make strong traction below the former 2024 high,

around $49,000 to confirm that being a reality.

However, the presence of various forms of negative divergence does suggest it is

possible. Analyst such as Michael Van De Poppe even believe a substantial correction of

over 40% could even happen.

This seems unlikely without a Black Swan event, such as a stock market crash.

Those seeking reasons why this could happen should take a look at the attached price

charts showcase large amounts of MACD and Daily Active Address price divergence.

Source: Santiment.net

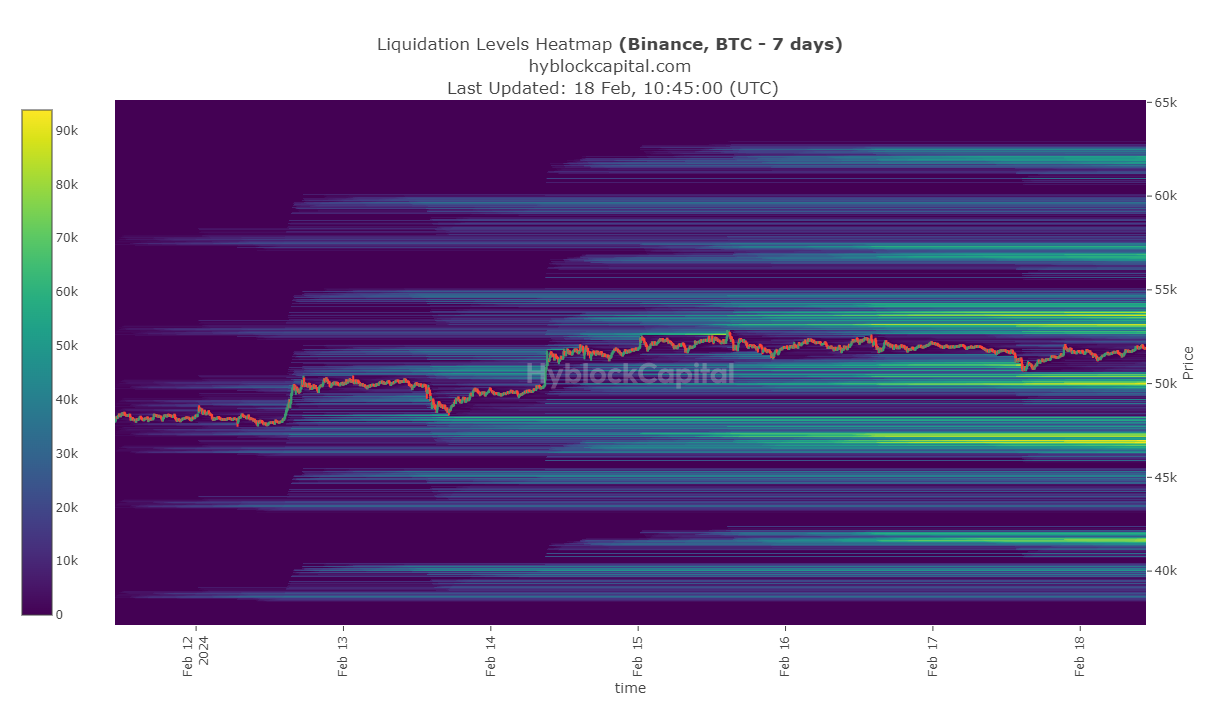

Also, consider liquidation data and leveraged positioning. Both show scope for market

makers of a downside sell shock to target the mentioned area.

Source: Hyblockcapital.com

The Demark indicator, often the preserve of hedge funds and crypto fund managers

suggests a "9" has formed, meaning an imminent correction or consolidation is

upon us.

Source: TradingView.com

Finally, Midwinter Capital's weekly Vanguard indicator still shows a strong buy signal.

Source: Midwintercapital.com

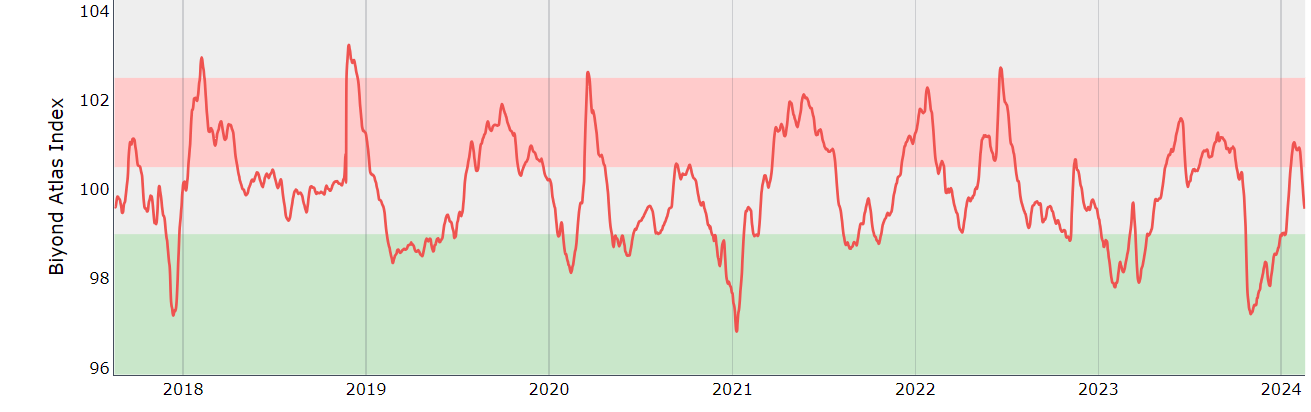

Midwinter Capital Atlas (inverse indicator) continues to show buy pressure building below

100.

Source: Midwintercapital.com